GIVE

Support FAME Scholars,

Programs, and Our Community

FAME depends upon the generosity of our community to sustain and advance our mission. Over the years, our Board, parents, alumni, grandparents and friends have helped provide the best possible educational environment for our Scholars.

Upcoming Events

Educational Improvement Tax Credit Program (EITC) &

Opportunity Scholarship Tax Credit Program (OSTC)

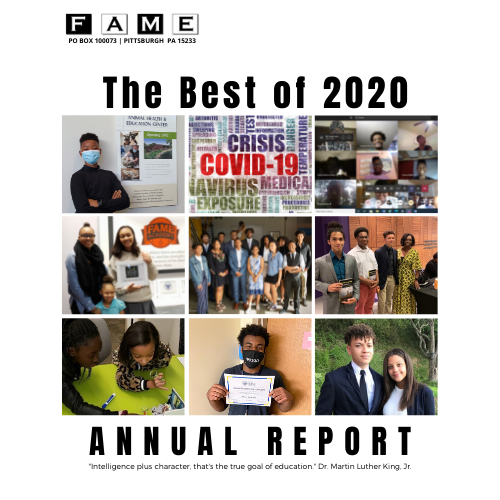

Annual Report

FAME's Fund Development team has developed comprehensive fundraising programs that provide opportunities for every member of our community to make a difference.

A gift of ANY size is appreciated.

For information, please contact the Fund Development office at

(412) 363-5553 or development@famefund.org.

Ways to Give to FAME

Annual Appeal

The annual giving program provides the essential unrestricted dollars that enhance the educational experience at FAME. Make A Donation.

Matching Gifts

Many employers sponsor matching gift programs and will match any charitable contributions made by their employees. To find out if your company has a matching gift policy that will benefit FAME, visit this link.

Campaigns

FAME identifies larger-scale needs for our programming and to fund those efforts, we often initiate a campaign.

EITC and OSTC

FAME is eligible to receive corporate gifts through two programs offered by the Commonwealth: the Opportunity Scholarship Tax Credit (OSTC) and the Educational Improvement Tax Credit (EITC). In return, Pennsylvania offers each participating company a tax credit for up to 90 percent of the value of the gift. Both programs provide FAME students financial aid; OSTC funds specifically benefit students from underperforming districts.

Endowment

Endowment gifts are invested for the long-term, creating a permanent source of funding for ongoing priorities, programs and projects identified by the Board of Trustees.

Fund-A-Scholar

FAME encourages the generous support of our community to provide a gift to assist in the education of our leaders of tomorrow. Sponsorship of our deserving scholars includes Academic Enrichment Lab instruction in the areas of Math, English, or Science; SAT and ACT preparation; text book costs, summer enrichment courses, and tuition.

Planned Giving

Planned gifts provide general and endowment support to FAME through individuals' wills and estate plans.

United Way

Every year, thousands of employees across Southwestern PA get involved in workplace giving campaigns. A workplace campaign is an organized, company-sponsored fundraising drive where employees are asked to contribute to United Way to help local people in need measurably improve their lives. FAME Scholars benefit tremendously from United Way contributions. Please consider FAME for your United Way contribution. #9809.

Events

Planned social events for the community, such as the FAME Fun 5K Run/Walk provide a sponsorship opportunity to support FAME's talented Scholars and FAME Academy students by making a tax deductible contribution.

Checks

Please make checks payable to FAME and send to: PO Box 100073, Pittsburgh, PA 15233.

Credit Card

FAME accepts donations charged to VISA, MasterCard and American Express. Make A Donation.

Gifts of Appreciated Securities

If you give appreciated securities to FAME, there are two benefits. First, you avoid paying capital gains taxes on the amount of the appreciation. Second, you can still deduct the full amount of the current value of the stock as a charitable income tax donation. If you cannot use all of the deduction in the year you make the gift; you may carry over the deduction for an additional five years. Please note: you must have owned the securities for at least one year.